Have A Tips About How To Apply For Tax Exempt Status

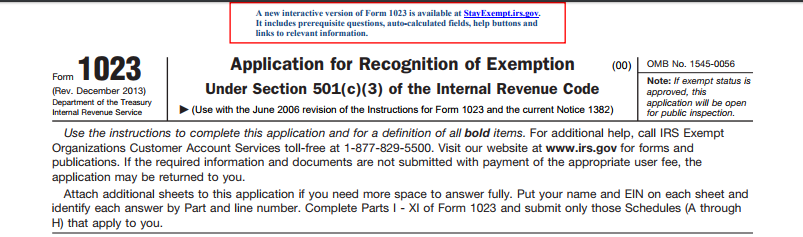

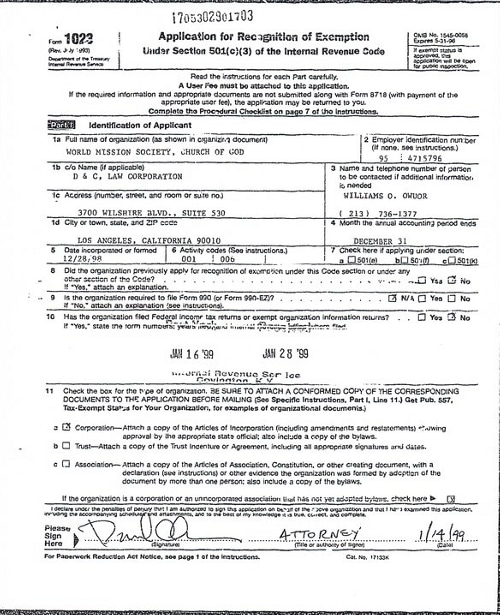

Four forms currently used by the irs are:.

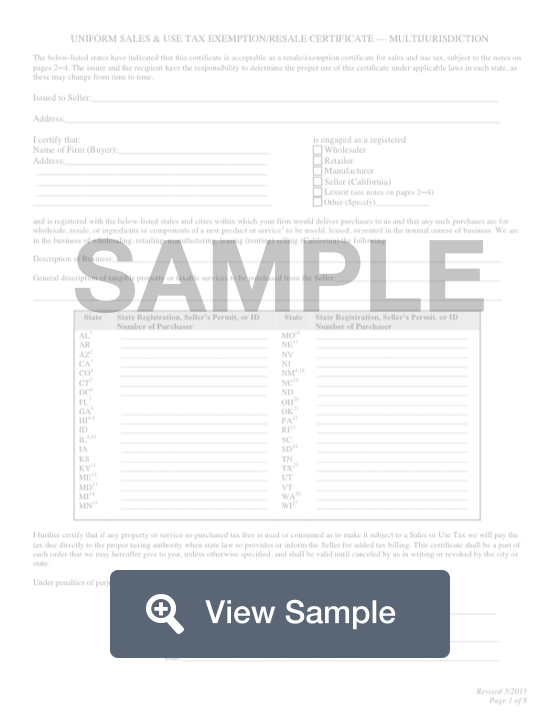

How to apply for tax exempt status. Expired zimbabwean exemption permit (zep) holders who do not apply to be in sa legally must be prepared to face the consequences. Institutions seeking exemption from sales and use tax must complete this application. Ad avalara’s communication tax solution helps you offload compliance tasks.

On the “account profile” page, scroll down to “company details”. Home affairs minister aaron motsoaledi. Ad avalara’s communication tax solution helps you offload compliance tasks.

So, you said the next step was applying? Section 1 must be completed by all institutions. In progress or accepted or.

How to apply for tax exempt status? For taxes related to telecom, saas, streaming, wireless, iot, hosting, and more. Questions and answers that will help an organization determine if it is eligible to apply for recognition of exemption from federal income taxation.

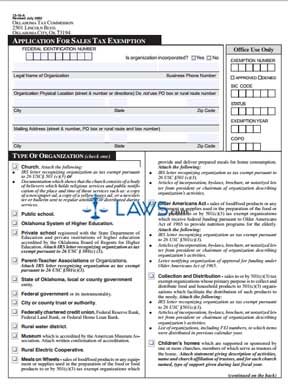

Most organizations applying for exemption must use specific application forms. For the first five years, the group will. Determine if your organization is one of the following:

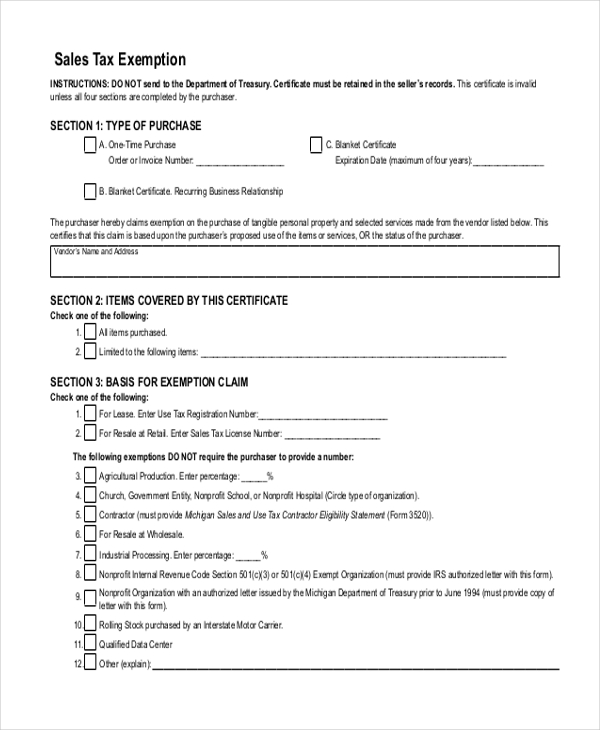

File an exemption under section 501 (c) (3) once you have legitimized your corporation and have all of your documents, you will be able to begin the filing process with the irs. Ad same day ups shipping & great low prices where the health of your animals comes first!. Submit the required documentation described in the instructions for form st.

Provide a copy of the statute or law creating or describing the federal or state.